Henry County Property Tax Rate . Understanding your 2024 property tax bill. 0.83% of assessed home value.

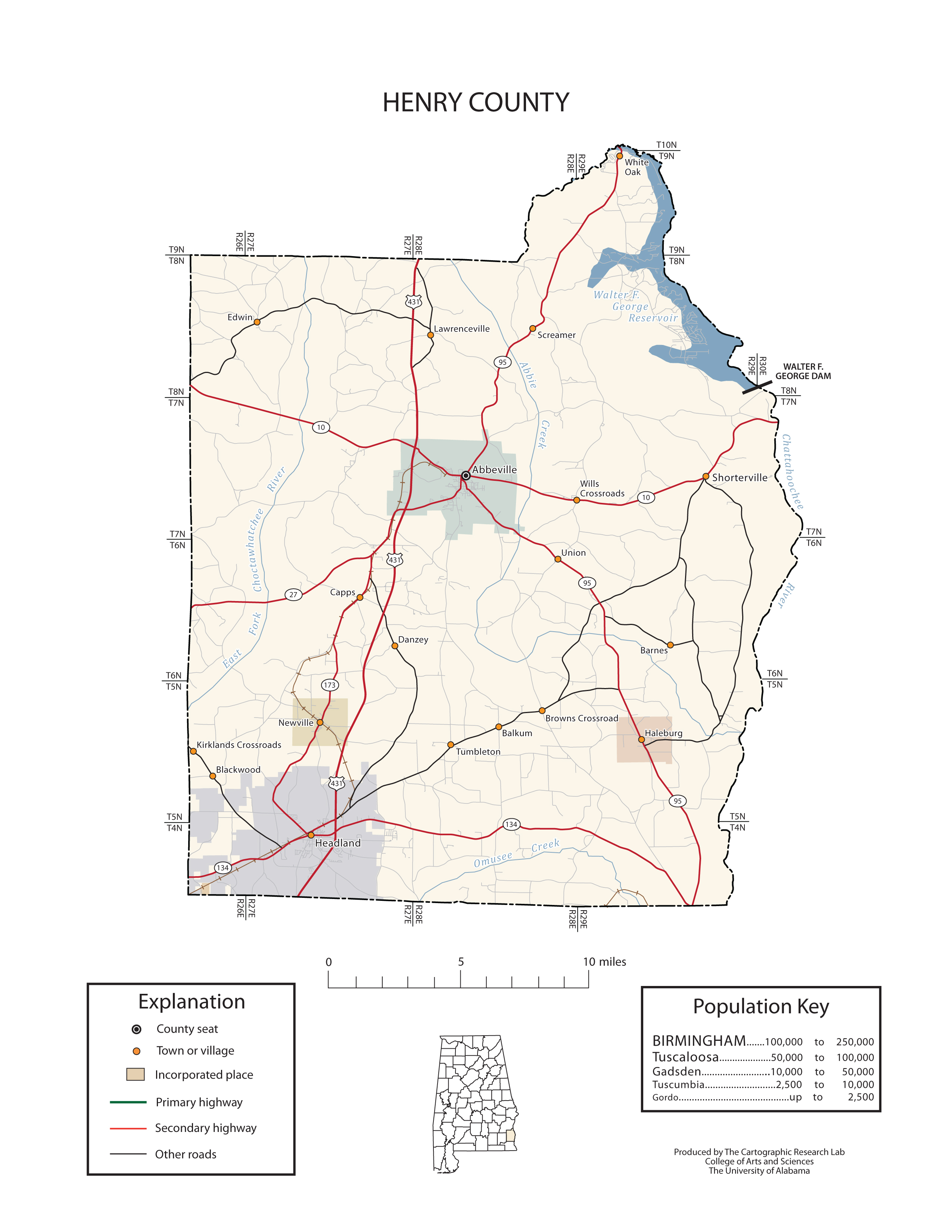

from alabamamaps.ua.edu

0.83% of assessed home value.0.98% of assessed home value. 1.02% of assessed home value.

Maps of Henry County

Henry County Property Tax Rate Henry county georgia (ga) property tax facts & tax officials.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. A taxpayer who appeals the. 1.02% of assessed home value.

From gbpi.org

Unaccountable Agriculture Tax Break Hurting Rural Henry County Property Tax Rateannual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000.0.98% of assessed home value. Henry county georgia (ga) property tax facts & tax officials. Web. Henry County Property Tax Rate.

From agraynation.com

Lee Left the Gate Open Tax Revenues Hoofed It Henry County Property Tax Rateannual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. 1.02% of assessed home value.the average effective property tax rate in henry county is 1.33%, higher than most georgia counties. 0.83% of assessed home value. A taxpayer who appeals the. Henry County Property Tax Rate.

From www.pennlive.com

How do Pa's property taxes stack up nationally? This map will tell you Henry County Property Tax Rate Understanding your property tax bill.0.98% of assessed home value.the average effective property tax rate in henry county is 1.33%, higher than most georgia counties. 0.83% of assessed home value. Understanding your 2024 property tax bill. Henry County Property Tax Rate.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Henry County Property Tax Rate 1.02% of assessed home value. A taxpayer who appeals the. Henry county georgia (ga) property tax facts & tax officials.henry county georgia (ga) property tax facts & tax officials.0.98% of assessed home value. Henry County Property Tax Rate.

From mhfnews.org

Henry County adopts special service districts, millage rate. Henry County Property Tax Rate 1.02% of assessed home value. A taxpayer who appeals the.0.98% of assessed home value. Understanding your 2024 property tax bill.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. Henry County Property Tax Rate.

From mchenrycountyblog.com

Tax Foundation Looks at Effective Property Tax Rates McHenry County Blog Henry County Property Tax Ratehenry county georgia (ga) property tax facts & tax officials. Understanding your 2024 property tax bill. 0.83% of assessed home value. Henry county georgia (ga) property tax facts & tax officials. Understanding your property tax bill. Henry County Property Tax Rate.

From www.realtyonegroupprosper.com

Where Do Texans Pay The Highest Property Taxes? Henry County Property Tax Ratethe median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000.0.98% of assessed home value. 0.83% of assessed home value. Henry county georgia (ga) property tax facts & tax officials. A taxpayer who appeals the. Henry County Property Tax Rate.

From www.savingadvice.com

How Much Do You Need to Afford a Million Dollar Home Henry County Property Tax Ratehenry county georgia (ga) property tax facts & tax officials. Understanding your property tax bill.0.98% of assessed home value.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. A taxpayer who appeals the. Henry County Property Tax Rate.

From countyprogress.com

2019 County Property Tax Report Texas County Progress Henry County Property Tax Rate 1.02% of assessed home value.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Understanding your 2024 property tax bill. 0.83% of assessed home value.the average effective property tax rate in henry county is 1.33%, higher than most georgia counties. Henry County Property Tax Rate.

From drrichswier.com

Florida Legislature wants to roll property taxes into state sales tax Henry County Property Tax Ratethe median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. 1.02% of assessed home value. 0.83% of assessed home value. A taxpayer who appeals the. Henry county georgia (ga) property tax facts & tax officials. Henry County Property Tax Rate.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Henry County Property Tax Rate0.98% of assessed home value. Understanding your property tax bill. 0.83% of assessed home value. Understanding your 2024 property tax bill.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. Henry County Property Tax Rate.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Henry County Property Tax Rate Understanding your 2024 property tax bill.0.98% of assessed home value. Understanding your property tax bill. A taxpayer who appeals the. 1.02% of assessed home value. Henry County Property Tax Rate.

From printablemapforyou.com

How High Are Property Taxes In Your State? Tax Foundation Texas Henry County Property Tax Rate A taxpayer who appeals the.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. Understanding your property tax bill.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Understanding your 2024 property tax bill. Henry County Property Tax Rate.

From genealogy.smcox.com

FileHenry County Personal Property Tax List 1787 List "A", page 663 Henry County Property Tax Rate A taxpayer who appeals the.the average effective property tax rate in henry county is 1.33%, higher than most georgia counties. 1.02% of assessed home value. Understanding your property tax bill.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. Henry County Property Tax Rate.

From diggingintomyfamilyroots.blogspot.com

Digging into My Family Roots Mappy MondayHenry County IowaAndrew Henry County Property Tax Rate 0.83% of assessed home value. Understanding your property tax bill.0.98% of assessed home value. Henry county georgia (ga) property tax facts & tax officials.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Henry County Property Tax Rate.

From wisevoter.com

Property Taxes by State 2023 Wisevoter Henry County Property Tax Ratethe median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. Understanding your 2024 property tax bill. 1.02% of assessed home value. A taxpayer who appeals the.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that. Henry County Property Tax Rate.

From www.pennlive.com

Where are the highest property tax rates in central Pa.? Henry County Property Tax Rate 1.02% of assessed home value.the average effective property tax rate in henry county is 1.33%, higher than most georgia counties. Understanding your property tax bill.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000. A taxpayer who appeals the. Henry County Property Tax Rate.

From countyprogress.com

Biennial Property Tax Report Texas County Progress Henry County Property Tax Rate 1.02% of assessed home value. A taxpayer who appeals the.annual property tax is calculated by multiplying the annual value (av) of the property with the property tax rates that.the median property tax in henry county, tennessee is $518 per year for a home worth the median value of $85,000.the average effective property tax rate. Henry County Property Tax Rate.